From the link:

http://www.investopedia.com/articles/financialcareers/08/hedge-fund-career.asp

Step 1. Be Sure You Really Want To Work For A Hedge Fund

Step 2. Become A Student Of The Hedge Fund IndustryIf working for a hedge fund is your goal, then create daily habits that work towards that goal. Examples are subscribing to free hedge fund newsletters, reading two to three chapters in a book on hedge funds each day or joining a local hedge fund association or club. To get a feel for where you might fit within the industry you need to learn the basics:

- Who are the major players in the industry?

- What terms/definitions are important to know?

Which strategies hedge fund managers commonly employ?

Use The Three-Circles Strategy

Step 4. Identify Hedge Fund CareerMentors

Step 5. Complete One or More Internships

Step 6. Develop Your Unique Value Proposition

Now that you have read articles, books and newsletters on hedge funds, completed a few internships and are developing mentoring relationships, it is time to figure out where you fit into the industry.

- What type of job would you like?

- What type of responsibilities are you seeking?

This is similar to the three-circles strategy, except now you need to take more definite actions towards deciding what role you will fill within the hedge fund industry. For example, if you want to be an

emerging markets analyst, write a few

white papers on emerging market investment analysis, or specialize your knowledge in one area by really digging in deep, say by interviewing at 10 emerging market funds and reading five well-researched books on the subject.

Don't be generic; be unique and find something you are passionate about. Define a niche and become very knowledgeable in that area compared to the average investment professional. Be careful not to let your knowledge go to your head - coming off as too proud or arrogant can definitely make it hard to get hired or promoted.

Step 7. Hedge Fund Job Tips

Each hedge fund is different, but across the industry there is a set of typical characteristics and skills that many hedge fund employers look for. Here are some of them:

- Quantitative experience and abilities - How much money

did you personally bring in to the firm or make for the last firm you worked for?

did you personally bring in to the firm or make for the last firm you worked for?

- Education - Ivy league, MBA, quant-focused PhD

- Signs of being loyal, passionate and humble

- Something extra, such as PR expertise, asset gathering ability or an information advantage

- CFA, CAIA or Chartered Hedge Fund Associate (CHA) designations

- High-quality names from your last few hedge fund jobs or large wire house experience

- A stomach for a high commission/bonus compensation structure

(Learn more about professional designations in our articles

CPA, CFA Or CFP® - Pick Your Abbreviation Carefully and

What Does "CFA" Mean?)

Step 8. Land The Unadvertised Hedge Fund Job One way of finding unadvertised job openings is by

cold-calling companies and firms from online Chamber of Commerce listings, industry directories or associations. In the hedge fund industry this could be done by networking through the Hedge Fund Group (HFG), Hedge Fund Association (HFA), HedgeWorld Service Provider Directory or your local CFA society.

Informational interviews can be a great way to land positions offering great training, experience and pay, and will be more relevant for you than a generic advertising. If you approach a small or fast-growing firm and show a true passion, commitment and confidence in working for them, a position can often be molded around your skill set. As a result, your job has much more potential to be a great fit with your strengths and desires.

| A Specialized ApproachTake this approach to searching for a position in the hedge fund industry: Meet with four prime brokerage firms, two administrators, and 20 hedge fund analysts and portfolio managers. Explain who you are, and ask if you can treat them to coffee to learn more about their business. If you learn enough about their business, they will in turn ask what you are looking for and how they might be able to help you achieve your goals. When the meeting ends, ask for the names of two or three additional individuals who might be able to meet with you and watch your network grow. |

Step 9. Consider Hedge Fund Service Provider Jobs

While some service provider jobs may seem less glorious than working directly for a hedge fund, there are great career opportunities for someone who is a very experienced

prime brokerage,

risk management or hedge fund administration. These types of positions expose you to a large number of individual hedge fund managers who might decide to hire you away at some point for your specialized expertise or relationships. Prime brokerage jobs in particular can be a training ground for

fund-of-funds marketing jobs and

third-party marketing careers. (Read

Fund Of Funds - High Society For The Little Guy and

Private Equity Opens Up For The Little Investor to learn more.)

Step 10. Apply To Hedge Fund Jobs

If you have worked through the previous nine steps, you now hopefully have a rough idea of what type of hedge fund strategy or service provider group you may want to work for. There are very few recruiters who will work with someone who has less than three years' experience working directly within the hedge fund industry. Many professionals successfully use experience from other industries to segue into the world of hedge funds, but recruiters usually will not work with this type of a placement candidate. Your best bets for getting that elusive placement are:

- the informational interview method above

- connecting with hedge fund professionals who graduated from your school

- joining the Hedge Fund Group (HFG)

- earning your CFA, CAIA or CHA designation

- attending hedge fund conferences to connect with professionals

If you get a chance to apply directly to a hedge fund, make sure you make the short list by following up with a phone call and asking to meet a few days after submitting your resume.

ConclusionMost hedge funds want individuals who are hungry, humble and smart. If you keep this in mind while moving through the 10-step plan above, you should have a great chance of getting your first hedge fund job and beginning a successful hedge fund career. Good luck!

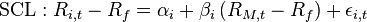

) is a parameter in the

) is a parameter in the

: the investment has earned too little for its risk (or, was too risky for the return)

: the investment has earned too little for its risk (or, was too risky for the return) : the investment has earned a return adequate for the risk taken

: the investment has earned a return adequate for the risk taken : the investment has a return in excess of the reward for the assumed risk

: the investment has a return in excess of the reward for the assumed risk